Deposit Invoices

Learn more about how to create, send, and log payment against a deposit invoice.

On this page:

View and email a deposit invoice

Create a deposit invoice

You can create a deposit invoice to collect a partial payment or full payment before an order goes into production. Deposit invoices allow you to invoice for a percentage of the order total before issuing a final invoice.

To create a deposit invoice:

- Scroll to the bottom of the sales order and select the box next to "Require a Deposit"

- Enter the percentage you want to collect into the "Deposit Percent" field; commonsku will calculate the deposit's dollar value after you enter the percentage

- Click the box next to "Allow credit card" to add an option for your client to pay by credit card (optional)

View and email a deposit invoice

Click View Deposit Invoice to preview the deposit invoice before emailing it to your client.

The client-facing deposit invoice displays:

- The deposit percentage and dollar amount due

- Quantities and pricing for all products on the order

- The order total

To email the deposit invoice to your client:

- Select Email Deposit Invoice

- Enter your email details

- Click Send Email

-png.png?width=688&height=409&name=Doc-Brown-s-Auto-Project-10773-New-Project%20(3)-png.png)

Log payment

The deposit section of the sales order will state "Deposit NOT Received" until payment is logged.

If your client paid through commonsku's credit card integrations:

- The payment details will automatically post in the deposit invoice's date received, the amount received, and confirmation number fields

- The deposit section of the sales order will automatically update to "Deposit Received"

- The person at the bottom of the deposit invoice form, as well as the invoicing contact will be notified once payment is made.

-

Your client will receive a payment confirmation email that includes:

- the deposit invoice number and project name

- the payment amount in the relevant currency

If your client did not pay through commonsku's credit card integrations:

- You will need to manually enter the deposit's payment date (Date Received), amount (Amount Received), and confirmation number (Confirmation # - optional)

-png.png?width=688&height=497&name=Doc-Brown-s-Auto-Project-10773-New-Project%20(4)-png.png)

- The deposit section of the sales order will automatically update to "Deposit Received" after the payment details are logged

The paid deposit will be deducted from the final invoice's subtotal. It's important to log payment before you create the final invoice.

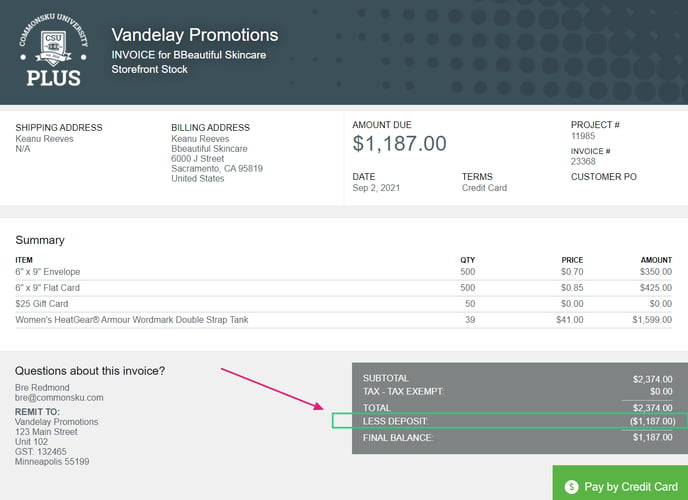

Final invoice

The deposit only shows on the client-facing invoice, it does not display on the final invoice's internal view. In the invoice, click Actions > Preview Invoice to see the final invoice with the deposit amount deducted.

This client-facing invoice displays:

- The original order total

- The amount received on the deposit

- The total less deposit

FAQ

- Why hasn't the deposit amount been deducted from my final invoice?

- I have checked the box to "Allow credit card," so why can't my client see the "Pay by Credit Card" button on the invoice?

- Can I export deposit invoices to my accounting platform?

- How do I track deposit invoices?

- Can I create multiple deposit invoices?

Why hasn't the deposit amount been deducted from my final invoice?

There are two reasons a deposit payment will not show on the final invoice:

- The invoice was created before the deposit's payment was logged. In this case, you'll need to delete the invoice (Actions > Delete Invoice) and create a new invoice

- There's more than one invoice in the project; in that case, the deposit is only deducted from the first invoice's subtotal. In this case, you can add a negative value service line to the second invoice to account for the deposit.

I checked the box next to "Allow credit card," so why can't my client see the "Pay by Credit Card" button on the invoice?

The deposit invoice wouldn't have a payment option if you emailed the invoice before selecting the box next to "Allow credit card." You can re-send the invoice after you choose to "Allow credit card."

Can I export deposit invoices to my accounting platform?

Deposit invoices do not export to accounting platforms. The best practice is to create a credit note/memo in your accounting platform to track the deposit. When you export the final invoice, you can log the credit note/memo against the invoice.

How do I track deposit invoices?

You can track unpaid deposit invoices through the Deposit Invoices Not Paid Report. You can track paid deposit invoices from your Finance Dashboard > Deposit invoices Paid and not in production tile. You can also refer to the credit notes/memos in your accounting platform.

Can I create multiple deposit invoices?

Each project can only have one deposit invoice, but there are a few workarounds to capture multiple deposit payments on your order:

- Create an invoice and add a negative value service line to account for the balance that's not yet due. For example, if the total balance is $1000, and you've already logged a $500 deposit on your order, the invoice will automatically show a balance due of $500. From there, if you need an additional payment of $250, you would add a negative value service line to reduce the total due by $250.

- Copy the sales order to a new project and create a new deposit invoice. Once your client pays that deposit invoice, change the (copied) sales order's status to Closed and log the payment details in the original project's overview. After that, you can either change the original sales order's deposit amount to represent the total paid or add a negative value service line to the final invoice.