Split ship taxes

Learn how to assign Split Ship Taxes through Avalara

On this page:

Review and validate tax calculations

Setting up Split Ship Taxes

Set up your project

Create and prepare your Estimate, Sales Order or Invoice in commonsku as you normally would.

To set up your Estimate, Sales Order or Invoice for Split Ship Taxes:

-

Add items, variants or breakdowns, shipping fees, and decoration

-

Verify that all Tax codes are correctly assigned to each item

-

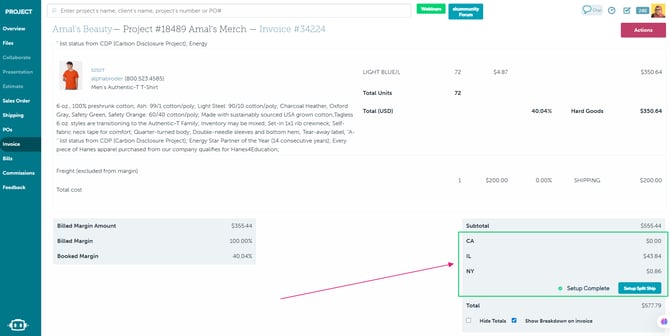

When ready, click the Set up Split Ship button at the bottom of your subtotal box to begin configuring split shipping

- Once this is done, follow the next steps below to Assign unique external SKUs to your product

To access the Set up Split Ship button, ensure that Avalara tax is connected in your setup. This option becomes available for configuration only after Avalara tax is selected as the Tax option.

Assign unique external SKUs

Each product variant must have a unique external SKU to configure split shipping.

To Assign unique external SKUs:

-

Click on the External Sku option to add a unique SKU to be assigned to your products.

-

Once all SKUs are assigned, the Continue button will become active at the bottom of the modal.

-

Click Continue to move to the Spreadsheet tab and click Download

- Once you are in the Spreadsheet tab, follow the steps below to configure your split ship spreadsheet

SKUs are unique to this project, but you can reuse your existing warehouse or system SKUs if they’re unique per variant. Without unique external SKUs added , you won’t be able to continue.

Configure your split ship spreadsheet

To configure your Split Ship Spreadsheet:

-

Click Download the sample spreadsheet template if you haven't done so, this template would have your product info already updated

- After downloading, open the spreadsheet and carefully update your client and shipping details

-

Once your information is configured, upload the completed spreadsheet to the platform

- If you get an error, click on view more to learn more about the errors, you will need to fix the spreadsheet and re-upload again

- When everything is validated correctly, you can select Calculate taxes with Avalara to generate your split ship taxes.

- Once taxes are calculated, go to the Review tab to confirm the amounts and jurisdictions (optional but recommended).

- To show clients how taxes are applied, select the checkbox to display a tax breakdown on the invoice. If you leave it unchecked, only the total tax amount appears.

- Once completed, it will show Setup complete and your split taxes will be updated in the order

If you see the commonsku loading icon, you can leave and come back later, your progress is saved.

If you receive an error stating line not found it usually means that some required information is missing such as email addresses or phone numbers. Please ensure all mandatory fields are completed before proceeding.

commonsku will also only process product lines that include both a quantity and a price. Any shipping, freight, fulfillment and other service lines are excluded from split ship tax calculations. If you need taxes applied to these, add them as custom products before proceeding.

You can refer to an example of a completed Split Ship Spreadsheet here

Review and validate tax calculations

Once your taxes are sent to Avalara, you’ll be redirected to the Review tab.

Here you can:

View the status of your tax calculations by 2 options:

Download Avalara Calculations

The Avalara Calculations refers to the JSON file of calculations to be used only for developers.

Download Tax breakdown

The Tax breakdown refers to the summary data for the jurisdiction and your tax liability per state.

Setup Complete

Once split ship taxes are configured correctly, you’ll see all taxes summarized at the bottom of the order.

These are grouped by State/Province based on the Avalara response when you select the option to display a tax breakdown on the invoice. If you leave this option unchecked, only the total tax amount will appear.

When everything is set up properly, the status will show as Setup complete.

FAQ

- Can I use SKUs from my warehouse or ERP system?

- Where can I find the Avalara tax summary?

- If I make changes to my order, will I need to re-configure my split ship taxes?

- Can split ship taxes be calculated in Deposit Invoices?

- Will Split ship taxes be compatible with Quickbooks or Xero?

- Why am I seeing an error for the country field in my uploaded spreadsheet?

- Why do I see a “Line Limit” error when uploading my CSV?

Can split ship taxes be configured without using Avalara?

Split ship tax functionality in commonsku is currently designed to work exclusively with the Avalara integration. At this time, you must have Avalara enabled to configure and calculate split ship taxes, and this integration is available to users on the Advanced and Enterprise plans.

What if my SKUs are not unique?

You’ll need to edit your product variants so that each has a unique SKU before you can proceed.

Can I use SKUs from my warehouse or ERP system?

Yes, as long as each SKU is unique per variant.

Where can I find the Avalara tax summary?

In the Review tab, you can download both the summary and raw tax response data.

If I make changes to my order, will I need to re-configure my split ship taxes?

Yes. If you update your order for example, by adjusting quantities, colors, sizes, or decoration locations, the split ship taxes will display a status of Incomplete configuration. In this case, you’ll need to reconfigure your split ship taxes again to ensure accurate calculations.

Can the split ship taxes be used in Deposit Invoices?

Yes. You can still configure split ship taxes on the Sales Order for Deposit Invoices. However, this functionality is not yet available for full payment invoices generated through Approve and Pay.

Will Split ship taxes be compatible with Quickbooks or Xero?

Split ship taxes are currently compatible with QuickBooks, but they are not yet supported for Xero integrations.

Why am I seeing an error for the country field in my uploaded spreadsheet?

Please ensure that the Country field in your spreadsheet matches Avalara’s accepted formats exactly.

Valid examples include:

-

United States

-

US

-

United Kingdom

Invalid formats (will cause errors):

-

USA

-

UK

Using unrecognized variations will prevent the file from processing correctly and may result in validation errors.

✔ Always use “United Kingdom” instead of “UK”

✔ Use “United States” or “US” (not “USA”)

If you have questions about this feature please email support@commonsku.com for further assistance.

Why do I see a “Line Limit” error when uploading my CSV?

This error is related to Avalara’s line limit, not commonsku.

By default, Avalara supports up to 1,000 lines per transaction. However, commonsku can handle up to 15,000 lines without any issues.

What’s the workaround?

You’ll need to contact Avalara Support and request a line limit increase to 15,000 lines. Once Avalara updates the limit on their side, the error should be resolved.