Zip2Tax

Zip2Tax is a sales tax calculator that automatically applies tax rates to your client-facing forms.

On this page

Apply the tax to an order, item, or service

Remove or update the tax on an order

Remove or update the tax on an item or service

Update the tax in a Pop-Up Shop

Update the tax in a Company Shop

Update the tax on a supplier bill

Add multiple taxes to split shipments

How it works

Zip2Tax generates a tax rate based on the order's ship-to location and prompts you to use a new tax rate anytime you change the shipping address.

Zip2Tax does not transfer sales tax details to external accounting platforms; it is designed for teams who have connected their QuickBooks Online account to commonsku and are using QuickBooks Online's automated sales tax.

Zip2Tax is not compatible with QuickBooks Online's manual sales tax, Xero, or QuickBooks Desktop.

Create your tax nexus

To create your tax nexus:

- Click your Profile icon (top right corner of commonsku) > Settings > Company Settings

- Click the Setup section

- Click the Tax Codes > Zip2Tax tab in the pop-up window

- Click + Add New

- Select a state from the drop-down and click Add

- Continue adding states as needed (optional)

Users need permission to Manage users, billing, and company settings to make adjustments to tax.

Apply the tax to an order, item, or service

Zip2Tax automatically applies a sales tax rate based on your order's shipping location and will update anytime you change the shipping location. The sales tax rate will appear on all products and services within the order.

Remove or update the tax on an order

To remove the tax from an order:

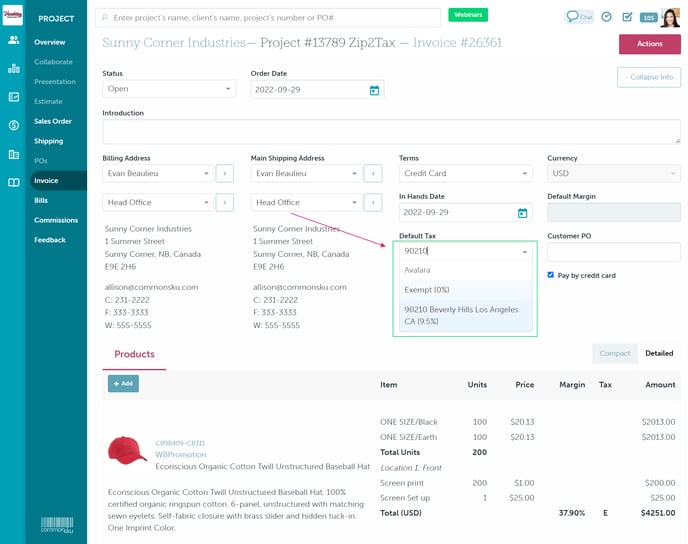

- In the estimate/sales order/invoice, click the "Default Tax" drop-down

- Select Exempt (0%)

To automatically update the tax on an order:

- In the estimate/sales order/invoice, click the "Main Shipping Address" drop-down

- Select the shipping address

- In the "Update Tax" pop-up, click Yes to update the tax rate

To manually update the tax on an order:

- In the estimate/sales order/invoice, click the "Default Tax" drop-down

- Type the zip code of the location you need to charge tax for

- Select the appropriate tax rate from the drop-down

Remove or update the tax on an item or service

To remove the tax from an item or service:

- In the estimate/sales order/invoice, hover over the line item and click Edit

- Select Exempt (0%)

To update the tax on an item:

- In the estimate/sales order/invoice, hover over the item and click on Edit

- In the edit item screen, scroll to the bottom right-hand cover and click the "Tax" drop-down

- Type the zip code of the location you need to charge tax for

- Select the appropriate tax rate from the drop-down

To update the tax on a service:

- In the estimate/sales order/invoice, hover over the service and click on Edit

- In the "Taxes" drop-down, type the zip code of the location you need to charge tax for

- Select the appropriate tax rate from the drop-down

Update the tax in a Pop-Up Shop

To update the tax code in a Pop-Up Shop:

- In the shop's Settings tab, scroll down to "Checkout Tax"

- Type the zip code of the shipping location you are collecting tax for and select the tax from the drop-down menu.

Update the tax in a Company Shop

A Company Shop requires you to pre-define your shipping address(es) and tax rate(s) before you can activate credit card payments.

To update the tax rate for credit card payments in a Company Shop:

- Select the box beside Credit card checkout (if already selected, simple deselect and then reselect)

- Choose a shipping address from the "Select from client" drop-down menu (the address needs to be specifically marked as a "Shipping" or "Both" on the client page) or locate the shipping address you'd like to update the tax rate on

- Type the zip code of the shipping location in the "Tax" drop-down menu and choose the appropriate tax rate

- Select the checkbox to apply tax on shipping charges or leave it deselected if shipping is tax-exempt

- Repeat steps 2-4 for all required shipping addresses

- Click Done

Update the tax on a supplier bill

To update the tax code on a supplier bill:

- In the supplier bill, click the "Default Tax" drop-down

- Type the zip code of the location you need to charge tax for

- Select the appropriate tax rate from the drop-down

Add multiple taxes to split shipments

The best practice for multiple taxes on split shipments is to:

- Separate the products based on where they are shipping to (i.e., if fifty shirts are shipping to two separate locations, split the product into two lines items)

- Edit each line item as needed and apply the appropriate tax code to the item

commonsku's QuickBooks Online integrations cannot export multiple tax codes on a single client invoice or supplier bill. You'll need to update taxes accordingly inside QuickBooks Online after exporting the invoice/bill.

FAQ

- How do I set a default tax rate for new clients and suppliers?

- Can I use a different default tax rate for services?

- Does commonsku offer tax reporting?

- What if my client's tax-exempt?

- How do I know what states/provinces I have to pay taxes to?

- Why is the tax different in commonsku than it is in QuickBooks Online?

- Can I use Zip2Tax if I'm not using QuickBooks Online's automated sales tax?

How do I set a default tax rate for new clients and suppliers?

There's no need to set a default tax rate with Zip2Tax. The tax will automatically generate based on the shipping location's zip code.

Can I use a different default tax rate for services?

Products and services automatically use the tax rate set in your estimate/sales order/invoice. There's no way to set custom rates per product or service charge, but they can be updated or removed as needed.

Does commonsku offer tax reporting?

commonsku does not offer tax or financial reporting. The best practice is to use your accounting software for tax and related financial reports.

What if my client's tax-exempt?

You can remove tax from the order if your client is tax-exempt. The best practice is to ensure the client is also marked as tax-exempt inside of QuickBooks Online.

How do I know what states/provinces I have to pay taxes to?

Check with your accountant to confirm what states/provide you need to pay tax to.

Why is the tax different in commonsku than it is in QuickBooks Online?

QuickBooks Online taxes are generated based on the tax agencies you've created inside of QuickBooks.

Can I use Zip2Tax if I'm not using QuickBooks Online's automated sales tax?

Zip2Tax isn't able to export tax details to external accounting platforms. You can still use Zip2Tax if you're not using QuickBooks Online's automated sales tax, but you will need to manually add taxes to all bills/invoices you export to your accounting platform.